Digital Asset (Crypto and Real- World) Investment, Risk and Compliance Intelligence.

Crypto Regulation

US Regulation

Through an unprecedented series of actions during the week of 20 January 2025, the US established itself as a prominent player in the cryptocurrency market.

SEC Crypto 2.0: Acting Chairman Uyeda Announces Formation of New Crypto Task Force: On 21 January 2025, the SEC Acting Chairman Mark T. Uyeda launched a crypto task force dedicated to developing a comprehensive and clear regulatory framework for crypto assets. Commissioner Hester Peirce was appointed to lead the task force.

US Executive Order: STRENGTHENING AMERICAN LEADERSHIP IN DIGITAL FINANCIAL TECHNOLOGY: On 23 January 2025, The White House issued an executive order that includes:

- The right of individuals and businesses to freely use, develop, and participate in open public blockchains without facing government persecution, including the right to self-custody of their digital assets.

- Encouraging the development and global adoption of stablecoins pegged to the US dollar.

- Protecting and promoting fair and open access to banking services for all law-abiding individual citizens and private-sector entities alike.

- Clear and consistent regulations are needed for a thriving digital economy. These rules should be technology-neutral, adaptable to new technologies, transparent, and clearly defined regulatory jurisdictions.

- Prohibiting the establishment, issuance, circulation, and use of a CBDC within the jurisdiction of the United States.

- Establishment of the President‘s Working Group on Digital Asset Markets to be chaired by the Special Advisor for AI and Crypto.

- Agencies and the Working Group must review and potentially revise existing digital asset regulations within 60 days. A report with policy recommendations will be submitted to the President within 180 days.

- The Working Group policy recommendations report shall consider provisions for market structure, oversight, consumer protection, and risk management.

- The Working Group shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts.

SEC rescinds SAB 121, freeing banks to provide digital asset custody: On 24 January 2025, the US Securities and Exchange Commission (SEC) rescinded SAB 121. The staff accounting bulletin required companies to list digital assets under custody as assets and liabilities on their balance sheets.

UK Regulation

The Financial Conduct Authority (FCA) adopted the UK financial promotions regime for cryptoassets on 8 October 2023.

In November 2024, the new UK government confirmed it would proceed with legislation to bring cryptoassets into the FCA’s regulatory perimeter. As such, on 26 November 2024, the FCA published its Crypto Roadmap, outlining planned policy publications on cryptoassets, with the majority happening in 2025. You can click the following link to access the FCA’s roadmap: https://www.fca.org.uk/publication/documents/crypto-roadmap.pdf. In summary, the upcoming FCA cryptoasset regulation will include rules relating to the following:

- Admission and Disclosures and Market Abuse. The FCA issued the discussion paper for this item in December 2024, and we will talk about it more below.

- Trading platform, intermediation, lending, staking, and prudential considerations for cryptoasset exposures.

- Stablecoins, custody, prudential (introduction of a new prudential sourcebook, including capital, liquidity and risk management).

- Conduct and firm standards for all Regulated Activities Order (RAO) activities. This includes Systems and Controls, including operational resilience and financial crime, Consumer Duty, Complaints, Conduct (COBS), and Governance, including Senior Managers and Certification Regime (SMCR).

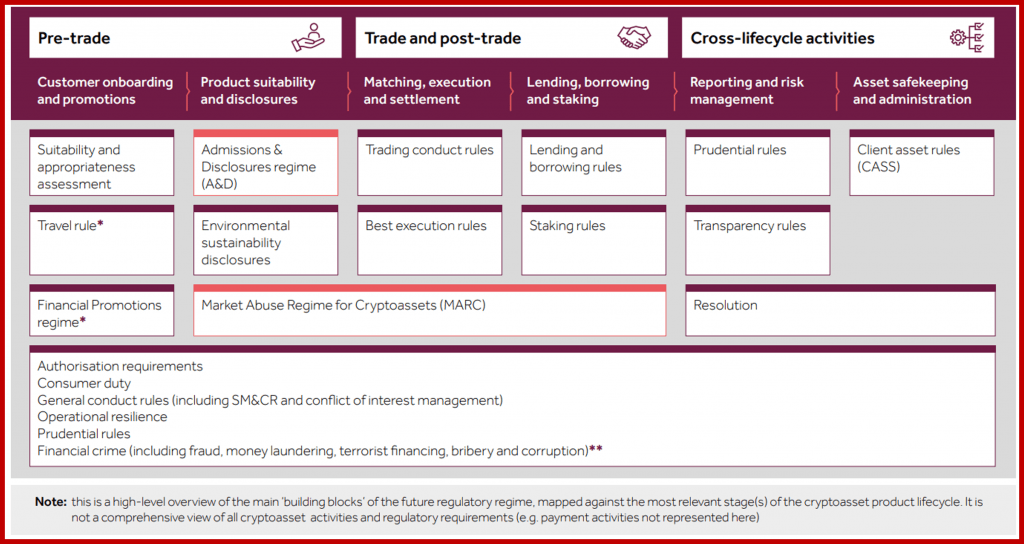

The picture below shows an overview of the future crypto regime in the UK.

Below is more information on the current regulations related to the cryptoasset financial promotion regime and the discussion paper related to Admission and Disclosures and Market Abuse.

Financial Promotions Regime for Cryptoassets

The FCA’s Financial Promotion Regime for Cryptoassets took effect on 8 Oct 2023 and applies to all firms that market cryptoassets to UK consumers, regardless of whether the firm is based overseas. To ensure firms clearly understand the requirements for cryptoasset promotions, alongside the FCA final rules (PS23/6) for Cryptoasset Financial Promotions published on 8 Jun 2023, the FCA published the Final Guidance for Cryptoasset Promotions (FG23/3) on 2 Nov 2023.

Under the regime, cryptoasset financial promotions must be fair, clear, and not misleading. SupraFin offers crypto risk analysis reports that can help with the required due diligence and the actual financial promotions.

Admissions & Disclosures and Market Abuse Regime for Cryptoassets

In December 2024, the FCA published a discussion paper titled “Regulating cryptoassets: Admissions & Disclosures (A&D) and Market Abuse Regime for Cryptoassets” (click the following link to access this paper https://www.fca.org.uk/publication/discussion/dp24-4.pdf).

Consumer Duty: Compliance with the Consumer Duty may require disclosures beyond those under A&D. In essence, the Consumer Duty will apply across the cryptoasset distribution chain, from product and service origination through to distribution and post-sale activities. This can include firms that do not have a direct customer relationship. The Consumer Duty may apply to firms in the wholesale sector that can determine or have a material influence over retail customer outcomes.

Disclosure Requirements:

- The Admission Document: There needs to be an admission document that would provide the core information a consumer needs to make an informed decision. Once accepted, the admission document would be filed on the National Storage Mechanism (NSM).

- Necessary Information Test for the Admission Document: There would be a ‘necessary information test for cryptoasset admission documents. This legal standard holds document preparers liable for consumer losses if they omit crucial information that would have helped consumers make informed investment decisions. This test would require minimum disclosures on features, prospects and risks of the cryptoassets, rights and obligations attached to the cryptoassets (if any), an outline of the underlying technology (including protocol and consensus mechanism), and where applicable and available, details of the person seeking admission to trading on a Cryptoasset Trading Platform (CATP).

- More detailed disclosures: Per public offers and prospectus regime in the POATRs, the FCA is considering introducing more detailed disclosure requirements in their Handbook rules to cover information related to governance, operational & cyber resilience, cryptoasset features, crypto ownership concentration, track record, stability mechanism, etc.

- Who is Responsible and for What? The person who initiates the application for admission to trading would be responsible and subject to the associated liability for the production and publication of any required admission documents, including if this person is the Cryptoasset Trading Platform (CATP) itself.

- Due diligence: The CATP would need to undertake due diligence on the issuer, any other persons associated with the offer, and the content of the admission document. The CATP would make a summary of this due diligence public.

- The CATP would take its own decision, based on an assessment of the likelihood of consumer detriment and level of comfort from its due diligence, on whether to approve or reject the application for admission to trading.

Liability Regime:

- The document preparer could be held liable for consumer losses if they did not include necessary information material to a consumer making an informed assessment of the cryptoasset.

- Statements relied on by consumers must be accurate. The Treasury proposed that the persons responsible for cryptoasset admission documents (including, in some cases, the CATP itself) should be liable for their accuracy. In general, and in line with the standards in the traditional securities market, the liability standard applied will be the ‘negligence’ standard under FSMA 2000 (see section 90 and schedule 10).

- In line with the approach in the public offers and admissions to trading regime under the POATRs there is a proposal to create a more favourable environment for the inclusion of forward-looking statements in cryptoasset admissions by adopting a lower liability standard (reckless instead of negligence) for issuers for certain type of forward-looking statements.

Rejection of Admission to Trading:

- CATPs would be required to publicly disclose their standards for admission of cryptoassets to trading, as well as their criteria for rejecting admissions.

- CATPs would be required to reject admission of cryptoassets if they consider that there is a significant risk this may result in consumer detriment. This approach would be similar to the FCA’s proposals for Public Offer Platforms (POPs) under the public offers and admissions to trading regime (see CP24/13).

- An outcomes-based rule would specify a non-exhaustive list of factors that CATPs will have to assess as part of their admission process. These CATPs must satisfy themselves that they understand any significant risks of consumer detriment related to these factors. Risks of consumer detriment may include, for example, material flaws in the design of the cryptoasset or its underlying technology, which might lead to a significant decrease in the value of the cryptoasset. These rules would ensure consistency and uphold high standards across CATPs when it comes to admitting cryptoassets to trading.

- Supervisory or Enforcement Action/Private Legal Action: If a CATP fails to comply with the FCA requirements or if there is evidence of negligence or misconduct, the FCA has the option of taking supervisory or enforcement action. Consumers may also have the right to take private legal action against the CATP under section 138D of FSMA 2000 for any contravention of an FCA rule.

Ongoing disclosures: Ongoing disclosures would be required after a cryptoasset is admitted to trading.

EU Regulation

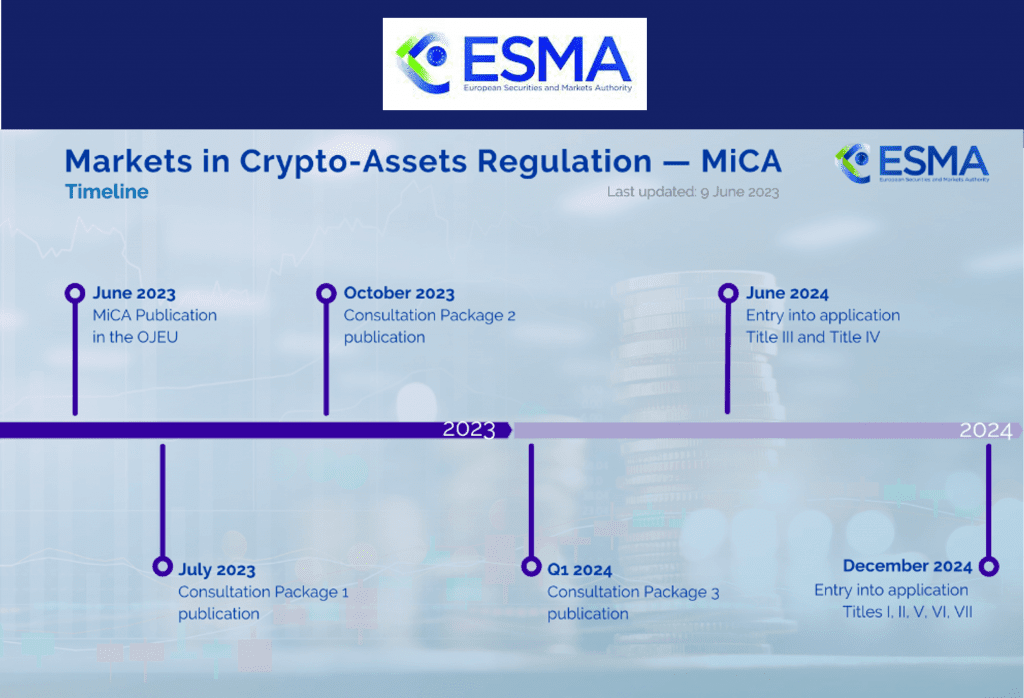

Markets in Crypto-assets Regulation (MiCAR or MiCA) regulates crypto-asset issuance and service provision in the EU.

MiCA came into force on 29 Jun 2023, with the provisions about asset-referenced tokens (ARTs) and electronic money tokens (EMTs) applicable from 30 Jun 2024. MiCA for the rest of the crypto-assets will apply starting 30 Dec 2024. As part of MiCA’s implementation, The European Banking Authority (EBA) and The European Securities and Market Authority (ESMA) have launched many consultations.

SupraFin has commented on many of these consultations and offers crypto-asset risk scores, risk analysis reports, and advice to help deal with the risk management required by the current and upcoming crypto-asset regulations. Contact us at [email protected] to learn about our products.

Below is more information on the consultations by ESMA and EBA.

Consultations related to MiCA by ESMA

During the implementation phase of MiCA, the European Securities and Markets Authority (ESMA) is consulting with the public on a range of technical standards that will be published sequentially in three packages. The date for the measures’ entry into application is subject to their adoption by the European Commission and approval by the European Parliament and the Council of the EU.

The first package, published in July 2023, included content of notification from selected entities to National Competent Authorities (NCAs), forms and templates for notification from entities to NCAs, content of the application for authorisation for Crypto-Asset Service Providers (CASPs), forms and templates for CASP authorisation application, complaint handling procedure, management and prevention, disclosure of conflict of interest, and intended acquisition information requirements.

The second package, published in October 2023, included sustainability indicators, business continuity requirements, trade transparency data and order book record-keeping, record-keeping requirements for CASPs, classification and templates and format of crypto-asset white papers, and public disclosure of inside information.

The third and final consultation package, published in two documents in January 2024 and one document in March 2024, covers all remaining mandates, including qualification of crypto-assets as financial instruments, monitoring, detection, and notification of market abuse, investor protection, reverse solicitation, suitability of advice and portfolio management services to the client, policies and procedures for crypto-asset transfer services (including clients’ rights), and system resilience and security access protocols.

Consultations related to MiCA by EBA

Under MiCA, The European Banking Authority EBA supervises “significant” ARTs and EMTs.

The EBA is also responsible for developing 17 technical standards and guidelines to specify further the requirements for any (significant and non-significant) ARTs and EMTs. As part of that, EBA has launched several consultations, five of which were due on 8 Feb 2024.

Below are the five consultations that were due on 8 Feb 2024:

1. Draft Guidelines on recovery plans under Articles 46 and 55 of the Regulation (EU) 2023/1114: set out an obligation for issuers of asset-reference tokens (ARTs) and issuers of e-money tokens (EMTs) to develop and maintain a recovery plan providing for measures to be taken by the issuer to restore compliance with the requirements applicable to the reserve of assets in cases where the issuer fails to comply with those requirements.

2. Draft Regulatory Technical Standards (RTS) to further specify the liquidity requirements of the reserve of assets under Article 36(4) of Regulation (EU) 2023/1114. Issuers of asset-referenced tokens, whether the asset-referenced tokens are classified as significant or not, are required to constitute and maintain a reserve of assets at all times.

3. Draft RTS to specify the highly liquid financial instruments with minimal market risk, credit risk and concentration risk under Article 38(5) of Regulation (EU) 2023/1114. Issuers of asset-referenced tokens, irrespective of whether they are significant or not, are required to decide to invest the proceeds they receive from the issuance of the tokens and form part of the reserve of assets, shall do it in financial instruments that are highly liquid and with minimal market risk, credit risk and concentration risk.

4. Draft RTS to specify the minimum contents of the liquidity management policy and procedures under Article 45(7)(b) of Regulation (EU) 2023/1114.

5. Draft RTS to specify the adjustment of own funds requirements and stress testing of issuers of asset-referenced tokens and of e-money tokens subject to the requirements in Article 35 of Regulation (EU) 2023/1114 on markets in crypto-assets.

Global Regulation

Final Report on DeFi by IOSCO

On Dec 19 2023, the International Organization of Securities Commissions (IOSCO) published its final report on DeFi, which includes nine recommendations for regulators worldwide. IOSCO is the international body that brings together the world’s securities regulators.

DeFi refers to the provision of financial products, services, arrangements and activities that use distributed ledger technology (DLT): decentralized exchanges (DEX), decentralized lending, DEX aggregators, yield aggregators, etc.

Below are IOSCO’s nine policy recommendations to address market integrity and investor protection concerns arising from DeFi.

1. Analyze DeFi products, services, activities, and arrangements in accordance with the principle of “same activity, same risk, same regulation/regulatory outcome.”

2. Identify responsible persons and entities of a purported DeFi arrangement that could be subject to its applicable regulatory framework. These responsible persons include those exercising control or sufficient influence related to the DeFi arrangement.

3. The regulatory approach should be functionally based to achieve regulatory outcomes for investor protection and market integrity that are the same as or consistent with those required in traditional financial markets.

4. Require responsible persons to identify and address conflicts of interest.

5. Require responsible persons to identify and address material risks, including operational and technology risks.

6. Require responsible persons to provide clear, accurate, and comprehensive disclosures to the DeFi products and services offered.

7. Enforce applicable laws on DeFi that are consistent with the principle of “same activity, same risk, same regulation/regulatory outcome.”

8. Promote cross-border cooperation and information sharing.

9. Understand and assess Interconnections among the DeFi market, the broader Crypto-Asset market, and traditional financial markets.

Latest News

Below are our most recent news. To view selected past events, webinars, and news related to SupraFin, please click here: https://suprafin.io/news-events/

April 8-10, 2025

Paris Blockchain Week

Join SupraFin at the forefront of crypto innovation at Paris Blockchain Week from 8 to 10 April 2025. Let’s connect!

The Team

Liliana Reasor

Director, Strategy & Leadership

Liliana is an entrepreneur and visionary with 25 years of experience in FinTech (risk management and compliance software), AI, technology, digital assets, and capital markets at JP Morgan, Deutsche Bank, Bank of America, Morgan Stanley, and Moody’s Analytics. She has an MBA from UCLA Anderson and an MS in Computational Finance from Carnegie Mellon University.

Laurent Nguyen-Ngoc

Chief Quant Officer

Laurent is an expert in quantitative finance. Previously, he was the US Head of Quants for IHS Markit in New York. He has 12 years+ of experience in risk & pricing models, structuring, and hedging. He has expertise in machine learning, risk-neutral pricing models, computational algorithms, and optimization techniques. He has a Ph.D. in Stochastic Calculus & Math Finance from Pierre & Marie Curie University, France.

Vidyaranya Vuppu

CTO

Vidya has over 20 years of experience in software development and leadership in information technology, including AI. He has four patents in the area of mobile connectivity and an AMIETE (Bachelor of Engineering) in Electronics & Telecommunications from the Institute of Electronics & Telecommunication Engineers in India.

The Advisory Board

Craig Dewar

FinTech Entrepreneurship

Craig is a FinTech serial entrepreneur and investor, and ex-investment banking professional. He co-founded Flex-e-card in 2000 before co-founding Global Processing Services. He was a former technology director in investment banking and front office systems within Salomon Brothers, JP Morgan, and CSFB.

Joachim Sonne

Strategy

Joachim is the former Co-Head of EMEA Technology, Media, and Telecoms Investment Banking at JP Morgan. He has 20 years+ of experience in technology, media, and telecom investment banking at JP Morgan in London, New York, and Frankfurt.

Pinar Emirdag

Tech, AI, Product Dev.

Pinar was most recently the former Co-lead in AI in Market Operations and Global Head of Digital Client Services and Digital and Platform Services at JP Morgan. She is an operator and senior executive with a proven track record in identifying and building technology-driven businesses, products, and services. She has previously worked for State Street, the London Stock Exchange, Citi, and ICAP, among others.

Toni Pettipiece

Business Development

Tony is the Chairman of the Board at GRIP, an Investment Banking and Wealth Management firm established within the Dubai International Financial Centre. He is a Board Member of the Global Digital Asset & Cryptocurrency Association in Chicago and a Principal at TPLLC, a Chicago-based digital consulting/investing company. He was the former Global Head of Prediction Trading at UBS and a Technology Manager at JP Morgan.

Colin Morrell

Business Coach & Mentor

Colin is an entrepreneur and business coach with 25 years of experience. He currently provides business coaching through Vistage Worldwide, an organization designed exclusively for high-integrity CEOs and executive leaders. He was previously the CEO of Appleyards Ltd, a consultancy business.

Adolfo Tunon

FinTech Advisor

Adolfo is a senior advisor at McKinsey & Company with 30+ years of experience in the financial services industry. He is a global transaction banking, payments, liquidity, sales, fixed income, and corporate relationship leader who worked as MD Regional Head of Products/Sales, EMEA Global Liquidity Cash Management at HSBC; MD Head of Cash and Trade, EMEA Global Transaction Services, at Royal Bank of Scotland, and MD and Head of Client Experience, Treasury and Trade Solutions, EMEA at Citi.

Ashish Kumar

Strategic Partner

Ashish is the founder of TribulusTech, a software development company. He is an entrepreneur with ten years of experience in FinTech, IoT, e-commerce, digital media, and media/entertainment businesses in India and globally. He is a financial partner to founders and CEOs, emphasizing strategic planning, investor relations, corporate development, business development, human resources, IT, business operations, and business analytics.

Connect with Us

Contact Us

Contact us at [email protected]

Copyright © 2019 SupraFin | Privacy Policy

As with all investing, your capital is at risk. The value of your digital assets / crypto currencies can go down as well as up and you may get back less than you invest.