Crypto Risk Scores/Ratings & Reports

Check SupraFin’s live demo of our crypto risk products at FinovateFall in NY.

Crypto Risk Scores/Ratings

1000+ Cryptos Assessed for Risk

SupraFin, a pioneer in crypto risk, has analysed the risk of each cryptoasset since 2018. We have assessed the risk of 1000+ cryptoassets.

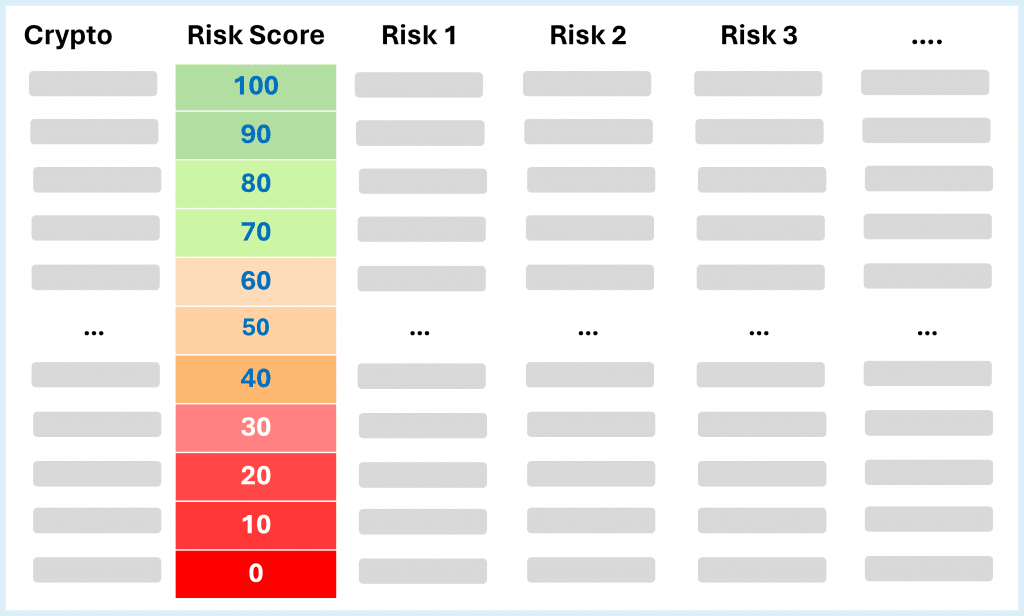

We offer risk scores based on risk frameworks per type of cryptoasset. Each risk framework depends on many risk categories/factors. For each cryptoasset, we provide the total risk score and the risk score per risk category/factor.

Customised: SupraFin can also create customised risk scores for a client’s selected universe of cryptoassets/cryptocurrencies.

Comprehensive Risk Frameworks: Our risk scores incorporate many risk categories/factors related to each type of crypto, not just market risk.

Risk Number: SupraFin assigns a risk score (0 to 100) to each cryptocurrency for each risk category/factor and an overall risk score. Cryptocurrencies/tokens with a 100 score have the lowest risk, and those with a 0 score have the highest risk.

Pricing

Please get in touch with us with any questions or to request a quote at [email protected].

API Documentation

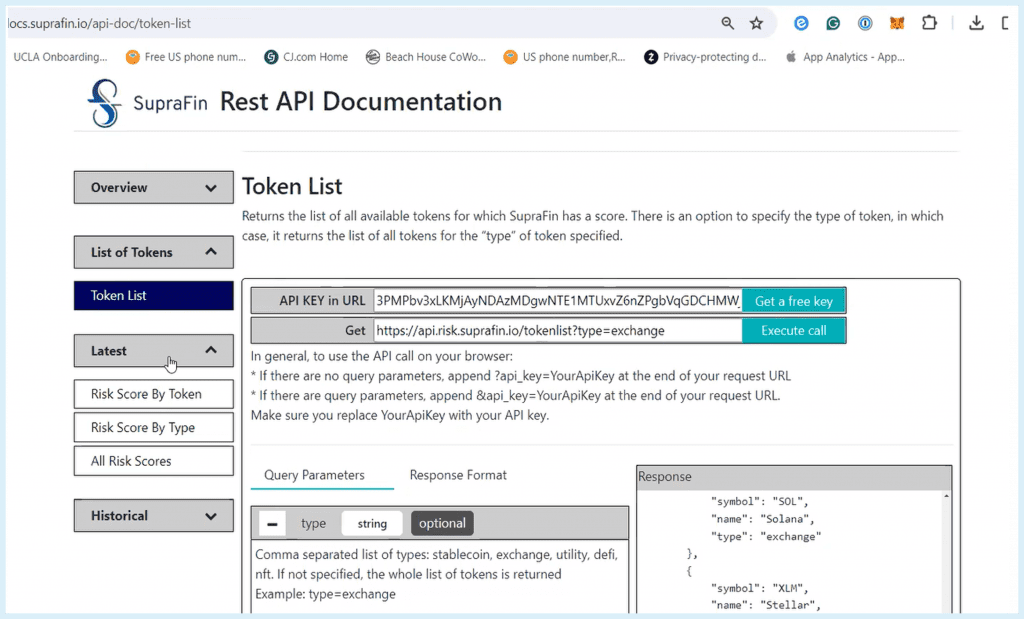

You can access our data through API or CSV files. We will provide you access to the API Documentation as part of the onboarding process.

Delivery Method

You can access SupraFin’s risk score data through REST API (JSON file format) or CSV file download.

Use Cases

Compliance: Regulated crypto exchanges/platforms, clearing houses, payment companies, and financial institutions that offer crypto to their clients need to assess the riskiness of cryptocurrencies for compliance purposes. SupraFin’s crypto risk scores provide solutions to comply with regulations (e.g., Consumer Duty, Financial Promotion Regime, MiCA, Fiduciary Duty, IOSCO).

Crypto ETP construction: Companies creating crypto ETPs can use SupraFin’s crypto risk scores as an additional selection criteria.

Crypto for customers with retail client base: Companies that offer cryptocurrencies to their retail client base can use SupraFin’s crypto risk scores on their crypto platforms to help their customers assess the riskiness of cryptocurrencies.

Crypto investment selection: Financial advisors, investment consultants, crypto funds/hedge funds, and investment groups can use SupraFin’s crypto risk scores as an additional source of crypto intelligence.

Crypto risk management: Any risk group that deals directly with crypto (payments companies, funds, custodians, exchanges, etc.) or indirectly (groups that assess the risk of companies involved with crypto) can leverage SupraFin’s crypto risk scores to determine the risk of cryptocurrencies.

Crypto trading teams and market makers at investment banks or crypto exchanges: Traders always want more smart information and data on anything they trade. SupraFin’s crypto risk scores provide traders with much-needed crypto intelligence.

Government financial stability surveillance: Regulators responsible for assessing financial stability in a region that needs to evaluate the riskiness of cryptocurrencies can leverage SupraFin’s crypto risk scores.

Ideal Clients

- Crypto exchanges

- Clearing houses

- Crypto ETP creators

- Investment managers that invest in crypto

- Asset managers that invest in crypto

- Risk managers that assess crypto or crypto companies

- Fund managers that invest in crypto

- Family offices that invest in crypto

- Crypto traders/market makers

- Fintech companies that offer crypto to their clients

- Payment companies that deal with crypto

- Financial institutions that provide crypto to their clients

- Financial Advisors

- Investment consultants

- Regulators

Early Risk Detection and Accuracy of Risk Scores

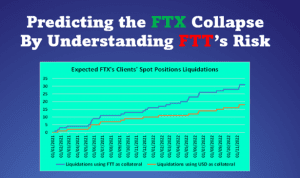

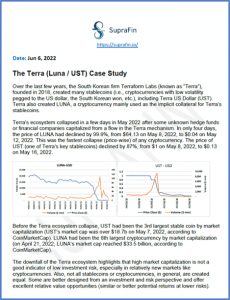

SupraFin has been building its risk framework for crypto since Jan 2018. SupraFin’s risk scores used on the risk reports are comprehensive (as required by FCA’s financial promotions regime) and, for example, detected the risks (stability, token designed) that led to the collapse of the Terra/Luna/UST ecosystem and the FTT/FTX ecosystem.

Crypto Risk Assessment Reports

SupraFin’s crypto research explains all of the risks related to a cryptocurrency based on our risk framework used for SupraFin’s crypto risk scores. Clients can select the universe of cryptocurrencies they want to buy SupraFin’s crypto research.

It can be used for UK compliance with cryptoasset due diligence, to understand how to reduce crypto risk, for market natural strategies, to educate traders, early crypto risk detection, and to know how to create better crypto baskets, etc.

Case Studies

Case Study: Predicting the Collapse of FTX by Understanding the Riskiness in FTT: Email [email protected] to get a free copy of this case study and to learn how SupraFin’s crypto risk scores detected the design flaw in the token design on this crypto since inception.

Case Study: Terra (Luna/UST): Email [email protected] to get a free copy of our case study on Terra (Luna/UST) and to learn how SupraFin’s crypto risk scores detected the design flaw in the stability mechanism on these cryptos since inception.

Pricing

Please get in touch with us with any questions or to request a quote at [email protected].

Use Cases

Compliance: Regulated exchanges, payment companies, and financial institutions that offer crypto to their clients need to assess the riskiness of cryptocurrencies for compliance purposes (customer protection). SupraFin’s crypto research provides crypto compliance intelligence. Currently, all cryptoasset companies selling in the UK must perform due diligence on the cryptoassets they list so that they can understand the risk of each cryptoasset and create financial promotions that are fair and not misleading.

Crypto ETP construction: Companies creating crypto ETPs can use SupraFin’s crypto investment/risk scores and crypto research as additional selection criteria.

Crypto for Retail: Companies that offer cryptocurrencies to their retail client base can use SupraFin’s crypto research to help their customers assess the riskiness of cryptocurrencies.

Crypto investment selection: Crypto funds/hedge funds and investment groups can use SupraFin’s crypto research as an additional source of crypto intelligence.

Crypto risk management: Any risk group that deals directly with crypto (payments companies, funds, custodians, exchanges, etc.) or indirectly (groups that assess the risk of companies involved with crypto) can leverage SupraFin’s crypto research for risk assessment of cryptocurrencies.

Crypto trading teams and market makers at investment banks or crypto exchanges: Traders always want more smart information and data on anything they trade. SupraFin’s crypto research provides traders with much-needed crypto intelligence.

Government financial stability surveillance: Regulators responsible for assessing financial stability in a region that needs to evaluate the riskiness of cryptocurrencies can leverage SupraFin’s crypto research.

Ideal Clients

- Regulators

- Crypto ETP creators

- Investment managers that invest in crypto

- Asset managers that invest in crypto

- Risk managers that assess crypto or crypto companies

- Fund managers that invest in crypto

- Family offices that invest in crypto

- Crypto traders/market makers

- Fintech companies that offer crypto to their clients

- Payment companies that deal with crypto

- Crypto exchanges

- Financial institutions that offer crypto to their clients