Past Events and News

Nov 25, 2025

FinTech Networking Meetup in London

April 29 to May 1, 2025

The event highlighted a massive shift toward RWA tokenization and institutional-grade risk intelligence, areas where SupraFin continues to lead the way.

May 27 to 29, 2025

Bitcoin 2025 in Las Vegas

April 1, 2025

EY’s 9th Global Blockchain Summit in Amsterdam

Insightful days in Amsterdam: SupraFin’s CEO participated in EY’s 9th Global Blockchain Summit to discuss the future of decentralized technology.

April 8 to 10, 2025

Paris Blockchain Week

March 18, 2025

100 Women in Finance

SupraFin’s CEO contributed to a high-level discussion on fintech opportunities at the 100 Women in Finance Global Fintech Committee event, held at Travers Smith’s London offices.

March 24, 2025

London FinTech Networking Meetup

SupraFin’s CEO joined industry leaders at a networking forum organised by Clear Junction and its fintech partners.

June 13, 2024

The Crypto Comeback: Will Regulation Pay the Way?

SupraFin’s CEO participated in a panel discussion in London organized by UCLA Anderson alums about regulation in the crypto industry.

Oct 7, 2024

J.P. Morgan Alumni Event in London

SupraFin’s CEO attended the JP Morgan alumni event in London, attended by many distinguished alumni from the UK and other parts of the world.

May 2, 2024

SupraFin Has Joined EY’s UK FinTech Growth Programme

We are excited to announce that we have joined EY’s UK FinTech Growth Programme. At SupraFin, we focus on providing crypto risk and investment intelligence solutions and helping organizations assess and reduce cryptocurrency risk and comply with regulations. With the help of EY’s expert team, we believe SupraFin will play an essential role in shaping the crypto industry.

June 6, 2024

The EY FinTech Growth Programme

SupraFin successfully concluded the EY FinTech Growth Programme on June 6. The six-week program was full of great networking opportunities, presentations by EY expert consultants, investors and successful entrepreneurs, and interactions with other companies in the programme.

April 15, 2024

Regulating Cryptoassets: FCA Admissions and Disclosures Policy Roundtable

SupraFin participated in the Financial Conduct Authority’s “Regulating Cryptoassets: Admissions and Disclosures Policy Roundtable”. It was great to be part of the UK’s efforts to ensure proper and proportionate cryptoasset regulation is created to allow a leading and sustainable cryptoasset industry in the UK that protects investors and the industry while enabling cryptoasset innovation.

April 30, 2024

Crypto UK Parliament Reception

SupraFin participated in the Spring reception at the Houses of Parliament in London.

April 9-11, 2024

SupraFin at Paris Blockchain Week

SupraFin met businesses interested in crypto risk & investment solutions at Paris Blockchain Week.

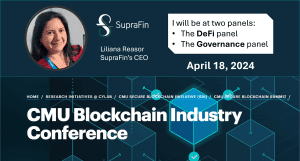

April 18, 2024

SupraFin at CMU’s Blockchain Conference

On April 18, 2024, SupraFin’s CEO will participate in two panels at Carnegie Mellon University’s Blockchain Conference: DeFi and Governance in Blockchain. CMU’s inaugural Blockchain Industry Conference will focus on real-world blockchain use cases and feature talks from industry practitioners.

October 18-19, 2023

SupraFin at Seamless Europe in Berlin

SupraFin exhibited and presented (“Understanding the Multifaceted Risks in Cryptocurrencies”) at Seamless Europe in Berlin.

October 25-26, 2023

SupraFin at The Europe Blockchain Convention in Barcelona

SupraFin was a VIP participant at the European Blockchain Convention in Barcelona.

Sep 19 to 20, 2023

SupraFin at Digital Assets Week, Singapore

SupraFin participated in the Digital Assets Week event in Singapore. We had many business discussions with all institutions participating in the event.

Also, we connected with participants and compared notes on the upcoming UK crypto regulation vs Singapore and Hong Kong.

October 4, 2023

SupraFin’s CEO at the JP Morgan Alumni event in London

As an alumna of JP Morgan, Liliana attended the annual JP Morgan alumni event in London.

May 10-11, 2023

FinTech Nexus, Financial Revolutionist, and FinTech Connector, New York

Liliana Reasor, SupraFin’s CEO, and Tony Pettipiece, SupraFin’s Advisor, participated at the FinTech Nexus event, The Financial Revolutionist’s networking event, and FinTech Connector’s dinner in New York.

Sep 11 to 13, 2023

SupraFin at FinovateFall, New York

SupraFin was selected to demo at FinovateFall. SupraFin had 7 minutes to show why it is an industry leader and disruptor in the crypto / digital assets industry. SupraFin showed how asset managers, funds, and banks can use SupraFin’s crypto solutions to reduce crypto risk, generate alpha, and comply with crypto regulations. Check the demo by clicking here.

March 14-15, 2023

SupraFin at Finovate Europe, London

SupraFin met with business clients, partners, and investors at Finovate Europe in London.

March 19 to 22, 2023

SupraFin at FinTech Meetup, Las Vegas

SupraFin met with business clients, partners, and investors at FinTech Meetup in Las Vegas.

Feb 9, 2023

FinTech Discussion – MSCF, Carnegie Mellon University (CMU)

SupraFin’s CEO was part of a CMU alumni panel discussion regarding trends in the FinTech industry.

Feb 13, 2023

Crypto Risk Scores/Ratings – Online Event

SupraFin presented the design of its crypto risk scores and how they can be used when assessing crypto risk for investment purposes or payments.

Jan 18, 2023

Managing Disruptive Technologies and Business Models

SupraFin’s CEO Liliana Reasor participated virtually, and Laurent Nguyen-Ngoc participated in person as guests speakers on Cryptocurrencies & FinTech, at the class titled “Managing Disruptive Technologies and Business Models” at UCLA Anderson School of Management taught by Brian Farrell.

Feb 1, 2023

Launch of SupraFin’s Crypto Risk Scores, Blacks Club, Soho, London

SupraFin launched its awaited crypto risk scores/ratings at a private event at the Blacks Club in Soho, London.

Nov 2, 2022

SupraFin at Global WealthTech Summit in London

SupraFin was at Global WealthTech Summit discussing its products with potential partners from the wealth management industry.

Nov 21 to 23, 2022

SupraFin at Finance Magnates in London

SupraFin participated in the event to discuss SupraFin’s products with potential partners from the trading industry.

Oct 17 to 18, 2022

SupraFin at FinTech Nexus – The Merge in London

SupraFin’s CEO was a speaker at FinTech Nexus. Some of the topics discussed were how to analyze crypto risk.

Oct 23 to 26, 2022

SupraFin at Money2020 in Las Vegas

Meet us at the Money2020 in Las Vegas from Oct 23 to Oct 26, 2022.

31st March 2022

SupraFin’s Exhibition at the Consensus Conference, Texas

SupraFin exhibited at the Consensus conference in Austin, Texas. SupraFin’s attendees included SupraFin’s CEO and SupraFin’s MD of Strategic Alliances.

Sep 28 to 29, 2022

SupraFin at The Trading Show in Chicago

Meet us at the Trading Show in Chicago from Sep 28 to Sep 29, 2022.

31st March 2022

SupraFin Introduces Crypto Deposits

“The SupraFin app’s crypto deposit feature lets people deposit 74 cryptocurrencies/crypto, including Basic Attention Token (BAT), Bitcoin (BTC), Bitcoin Cash (BCH), Chainlink (LINK), Dai (DAI), Ethereum (ETH), Filecoin (FIL), Litecoin (LTC), Tezos (XTZ), Uniswap (UNI), USD Coin (USDC), and Zcash (ZEC), among others.

10th May 2022

Cryptocurrencies, the Metaverse, and Web 3.0

SupraFin hosted a webinar where the concepts of metaverse, web 3.0, and cryptocurrencies were explained. The webinar also focused on the connection between Metaverse, Web 3.0, and Crypto and how to invest in those sectors.

3rd Feb 2022

SupraFin Launches Exclusive Crypro Reports

SupraFin announced that it has released a new feature on its app to let users access exclusive crypto investment reports on cryptocurrency on their portfolio.

21st March 2022

SupraFin Awarded Category Winner for Blockchain and Cryptocurrencies in the US Categories at the WealthBriefing WealthTech Americas Awards 2022

“Judges noted that SupraFin had developed an app that allows users to create a basket of cryptocurrencies based on risk tolerance and suggests to the user when to rebalance. A very useful tool and an excellent submission.”

12th January 2022

Managing Disruptive Technologies and Business Models

SupraFin’s CEO Liliana Reasor participated virtually as a guest speaker on Cryptocurrencies & FinTech at the class titled “Managing Disruptive Technologies and Business Models” at UCLA Anderson School of Management taught by Brian Farrell.

19th January 2022

SupraFin, as part of the UCLA Anderson Venture Accelerator, was interviewed by Poets & Quants, US

The Venture Accelerator was started in 2018. Since then they have supported more than 165 companies, which, combined, have raised more than $150 million in venture capital.

For SupraFin it was Perfect Timing to join the UCLA Venture Accelerator as it focuses on companies that have just launched. “We want to speed up SupraFin’s growth in the US”.

3rd December 2021

SupraFin Joins the Venture Accelerator at UCLA Anderson to Speed Up Its US Expansion

SupraFin’s CEO commented: “I am thrilled the UCLA Anderson Venture Accelerator has accepted SupraFin to its 2022 cohort. We are 100% focused on growing our presence in the US as this is our key market. Joining the UCLA Anderson Venture Accelerator will help us leverage the incredible UCLA community and other UC-related communities and benefit from all the excellent resources available through the accelerator.”

14th December 2021

Crypto Event and Announcement of the SupraFin Android App Release, Los Angeles

SupraFin hosted a cryptocurrency educational event in Los Angeles in Dec 2021, where it announced the release of its Android App. Representatives of The Venture Accelerator at UCLA Anderson attended the event. SupraFin discussed how the cryptocurrency industry has evolved, some of the most well-known cryptocurrencies, and the ease of adding tokens to your portfolios using the SupraFin app.

19th October 2021

How to Invest in Cryptocurrencies?

SupraFin hosted a webinar regarding how to invest in cryptocurrencies (“crypto”) and covered the topics listed below.

How volatile is the cryptocurrency industry?; what are some of the risks to consider when investing in crypto?; which are the best cryptocurrencies?; do you have the knowledge to invest in crypto successfully?; how can you invest in crypto successfully?; and do you have the right technology tools to invest in crypto successfully?

19th October 2021

SupraFin Has Teamed Up with Gemini to Act as Exchange and Custody Provider for SupraFin’s Clients

Dave Abner, Global Head of Business Development, Gemini, commented on the SupraFin launch:

“We’re excited to be powering SupraFin’s vision to offer diversified crypto portfolios based on risk profile preferences. As part of our mission to empower the individual through crypto, Gemini is the leading provider of institutional solutions for those who want to offer innovative digital asset investment offerings.”

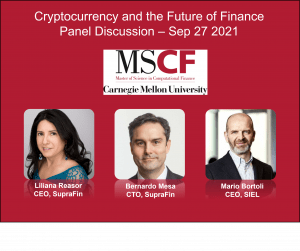

27th Sep 2021

Cryptocurrency and the Future of Finance – MSCF, Carnegie Mellon University

SupraFin’s CEO and CTO participated as panelists at CMU’s MSCF (Master of Science in Computational Finance) online event: Cryptocurrency and the Future of Finance.

13th October 2021

Do You Know Which Crypto to Buy? SupraFin Launches App to Help Anyone Invest in Cryptocurrencies Like a Pro

According to Crowdfundinsider: “SupraFin provides an intelligent app with institutional-like investment algorithms in the background that assess the relative value of hundreds of cryptocurrencies and recommends the most appropriate as part of a diversified portfolio based on the client’s risk profile preferences.”

16th Sep 2021

SupraFin Launches the First Crypto Portfolio Management App Set to Transform the US Market

“DOVER, Del., Sept. 16, 2021 /PRNewswire/ — SupraFin USA, Inc. today announced the release of the SupraFin app in the US market. The SupraFin app is the first app with smart crypto investment algorithms in the background that assess the relative value of thousands of cryptocurrencies and recommends the most appropriate as part of a diversified portfolio based on the client’s risk profile preferences. The app allows any individual interested in cryptocurrencies to invest as little as $100.”

16th Sep 2021

SupraFin Launches First App Providing Sophisticated Crypto Investment Algorithms to the Masses

According to Crowdfundinsider: “SupraFin is democratizing sophisticated crypto trading for the masses. Launched this week and available for download via the Apple App Store, SupraFin has announced the first app with smart crypto investment algorithms that assess the relative value of thousands of cryptocurrencies and recommends the most appropriate as part of a diversified portfolio based on the client’s risk profile preferences.”

6th July 2021

FinTech Podcast – Interview by CMS of SupraFin

In the new episode of FinTech Bytes, Vanessa Whitman, Partner at CMS, interviews Liliana Reasor, CEO and Founder of SupraFin, on how decentralized finance is impacting the future of financial services, how the digital assets space has changed during the pandemic, and what the long-term impacts of these developments will be for the FinTech ecosystem.

4th Aug 2021

Summer Event: SupraFin Team Gathering to Discuss the Launch in the US

SupraFin’s team and key stakeholders got together at Boisdale in Canary Wharf to discuss strategy, including the September SupraFin app launch in the US.

19th April 2021

Smart Discipline Guides SupraFin’s Digital Assets Platform – WealthBriefing

“A person who is intrigued by digital assets but who doesn’t want to stare at a computer screen all day might prefer to give his or her risk tolerances to an expert manager and let the latter press the buttons. And this is where a business such as UK-based SupraFin (https://suprafin.io)”

13th May 2021

UCLA Cross Campus Alumni Series: Cryptocurrency and Blockchain

SupraFin’s CEO participated in a lively discussion with other UCLA alumni panelists from the law, engineering and business schools at the University of California – Los Angeles (UCLA). They shared their insights on the dynamic and rapidly evolving Cryptocurrency and Blockchain industry.

8th March 2021

SupraFin’s CEO Was Featured by the MS in Computational Finance at Carnegie Mellon University

SupraFin’s CEO shares her thoughts on how the MSCF program prepared her for a career in quantitative finance. You can read her interview here.

25th March 2021

CMU Alumni Panel: What’s Ahead for Cryptocurrencies and Blockchain?

As 2021 begins, the often-volatile market for cryptocurrencies and blockchain stocks has been hot. The corporate acceptance rate is accelerating among leading firms like MasterCard, BlackRock, Bank of NY Mellon and even Tesla, lending increased legitimacy to digital currencies and blockchain platforms. Join SupraFin’s CEO and other CMU alumni leaders in the blockchain field on this online event, titled “What’s Ahead for Cryptocurrencies and Blockchain?.

21th Jan 2021

Things to Know Before Investing in Cryptocurrency

SupraFin hosted a webinar titled: “Things to Know Before Investing in Cryptocurrency”. You can access the video for the webinar through this link: YouTube video

4th March 2021

SupraFin’s CEO Was Featured at the Mobile Century Magazine: The Future Reimagined

At this publication, she discusses how she recognized the trend to digitalization of financial services very early on and how cryptocurrencies could transform the investments and capital markets industry.

15th to 16th Sep 2020

SupraFin will Present and Exhibit Virtually at WLTH 2020

WLTH was an online event where speakers discussed how innovation and technology is helping re-imagine wealth & asset management. SupraFin focus was on wealthtech and crypto.

2nd Dec 2020

India Fintech Forum

SupraFin’s CEO participated in a panel discussion titled: Should crypto be part of a retail investment portfolio.

20th Aug 2020

SupraFin Presented Virtually at BitAngels Las Vegas

SupraFin presented on 20th Aug virtually at BitAngels Las Vegas.

11th Sep 2020

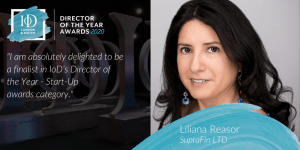

Director of the Year Award at IOD

SupraFin’s CEO was selected was a finalist in the startup category for the Director of the Year Award at the Institute of Directors.

8th Jul 2020

SupraFin’s Global Webinar: The Future of Crypto Assets

In this webinar a panel of experts discussed the Future of Crypto Assets. Topics discussed included, the most innovative crypto asset types; crypto asset types with the most potential in the future; the relationship between crypto assets, finance and technology; benefits of tokenization; how to improve the likelihood that a utility token is successful, and more.

22nd to 23rd July 2020

SupraFin Exhibited Virtually at Global FinTech Fest

Global FinTech Fest was the largest online global FinTech meetup. It was organized by the National Payments Corp. of India (NPCI), Fintech Convergence Council (FCC) and Payments Council of India (PCI). The event had 10,000 attendees and 100,000 views.

22nd June 2020

SupraFin’s Global Webinar – Everything You Need to Know About Crypto Assets

SupraFin organized a webinar for beginners on crypto assets. What are crypto assets?, how many are there?, types of crypto assets, how should you analyze them?, how have crypto assets performed?, how to use analytical tools to understand crypto assets, and more.

19th June 2020

SupraFin Was Selected as a Finalist in Digital Assets

SupraFin was selected as a finalist in the Digital Assets Category by Innovate Finance, the independent FinTech industry body in the UK.

11th May 2020

SupraFin’s Global Webinar – The Current State of the Cryptoasset Market

Presented by cryptoassets and quant experts, this global webinar provided a deep analysis using blockchain and market data to understand how cryptoassets performed during the lockdown.

26th May 2020

The Accelerating Adoption of Emerging Technology, CityA.M.

On 26th May, Appold, an emerging technology advisory and investment company launched with CityA.M. Appold plans to capitalize on the accelerating adoption of emerging technologies and has selected SupraFin as one of the companies with best chance of success and highest potential for growth.

28th Feb 2020

Reimagining Finance: My FinTech Journey, Imperial College Business School, London

SupraFin’s CEO joined Imperial College Business School’s panel on Friday to discuss Reimagining Finance: My FinTech Journey. FinTech founders shared their company stories with the aim to inspire the next generation of FinTech entrepreneurs. FinTech founders shared their huge enjoyment from building transformative businesses.

9th April 2020

SupraFin’s Global Webinar – FinTech and Cryptoassets in Times of Covid-19

Organized only one week in advanced, this global event was well attended with 100 participants from 16 countries. The webinar covered: a macro market perspective of the Covid-19 crises; learning from past market crises; opportunities created for FinTech companies by the accelerated digitization of the world; and what Covid-19 could mean for Cryptoassets.

11th Feb 2020

LWF’s FinTech Masterclass at Deutsche Bank’s HQ, London

SupraFin’s CEO was part of a panel that discussed startups and scale-ups in FinTech and collaboration with financial institutions’ innovation groups.

17th Feb 2020

SupraFin’s First Educational event – Cryptoassets Masterclass, London

SupraFin organized its first cryptoassets masterclass at Rise London. Presenters explained what are cryptoassets, how wealthtech and the blockchain can bring financial inclusion, and how SupraFin provides cutting edge analytics to help individuals invest in cryptoassets in a smart, transparent, automated, customized and safer way.

18th Nov 2019

YDF Den at Institute of Directors, London

SupraFin presented at IoD’s annual Dragons Den style pitching competition. SupraFin was one of the four finalist that presented at IoD in front of a large audience.

21st to 24th Jan 2020

Davos

SupraFin presented at World Innovation Economics and participated in many FinTech, cryptoassets, and financial inclusion events in Davos during the WEF week. Check out our short video next to this paragraph.

11th Nov 2019

Digital Impact Summit in London

SupraFin’s CEO, was a speaker at the Financial Inclusion panel and SupraFin was an exhibitor at Digital Impact Summit. Digital Impact Summit is the world’s leading global network for fintech, blockchain and digital impact.

12th Nov 2019

Blockchain Meetup – How Blockchain and Digital Assets are Evolving and Being Used in Our Daily Lives, London

SupraFin’s CEO, gave a presentation on the following: a) how WealthTech is transforming the asset management industry, b) inefficient markets and what that means for investing in cryptoassets, and c) bringing financial inclusion through WealthTech and cryptoassets.

14th Oct & 15th Oct 2019

X-TECH Europe: Financial Services & Technology by CEFPRO in London

SupraFin’s CEO, Liliana Reasor, and SupraFin’s Ambassador, Adolfo Tunon participated as speakers in the FinTech and Emerging Technology Stream.

6th Nov 2019

JP Morgan’s Alumni Event in London

Liliana Reasor, SupraFin’s CEO, attended JP Morgan’s annual alumni event. About the event, she said: “It was great to meet so many alumni and learn about their new endeavors. It was a lovely evening. Lastly, I was delighted to meet Jamie Dimon (CEO of JP Morgan) at the event.”

24th Sep 2019

MBN UK Exclusive Event: Unravelling Crypto & Blockchain at IoD in London

SupraFin’s CEO, Liliana Reasor, 20|30’s Asset Management’s CEO, Robert Gaskell and Novum Insights’ CEO, Toby Lewis were part of a panel that discussed the future of crypto, tokenization, crypto asset management, and FCA’s recent guidelines on crypto.

4th Oct 2019

SupraFin was featured on Crowdfundinsider

Crowdfundinsider wrote an article about SupraFin and it’s CEO, Liliana Reasor. The article was titled: “Wealthtech Platform for Digital Assets SupraFin Gains TribulusTech as Investor & Software Partner”

9 Sep 2019

SupraFin Signs Strategic Agreement with TribulusTech

SupraFin has signed a strategic agreement with TribulusTech. As part of the agreement, TribulusTech has agreed to commit a team of 9 professionals to finish building the SupraFin platform, which is expected to be launched by March 2020. Click here for more details.

13 Sep 2019

SupraFin – The WealthTech Platform of the Future at Institute of Directors, London

SupraFin hosted its ambassadors, investors and other members from the crypto / FinTech community and gave an overview on SupraFin and its current progress. SupraFin announced its strategic partnership with TribulusTech to build the SupraFin platform.

15 Aug 2019

London Blockchain Community Summer Drinks

The entire London Blockchain Community met for summer drinks and networking at the famous Dickens Inn at St Katharine Docks. SupraFin’s team and partners participated in the activities, including meeting visitors from Asia and engaging in new partnership disicussions.

2nd Sep 2019

LAToken Investors’ Reception in London

SupraFin’s CEO, Liliana Reasor was invited to participate in the exclusive investors’ dinner organized by LAToken in London. LAToken is an exchange for digital assets.

25th June 2019

Crypto AM First Anniversary Party at Smith & Wollensky in London

200 people from the crypto community in London celebrated Crypto AM First Anniversary Party at Smith & Wollensky in London. Crypto AM is part of City AM (a business focused news paper distributed in London). SupraFin’s CEO, Liliana Reasor, and SupraFin’s partners participated in the event.

30th May 2019

The 5th Industrial Revolution at Altitude London

SupraFin’s CEO presented at the Ideal App Tech event at Altitude London. Can London Become a Blockchain-Powered City? She discussed how Blockchain is transforming the finance industry and SupraFin’s vision to be The WealthTech Platform of the Future by targeting the digital asset industry.

2nd May 2019

FinTech Class at Imperial College Business School

SupraFin’s CEO, Liliana Reasor, was a guest speaker at a FinTech class by Dr. Miquel Noguer i Alonso at Imperial College Business School. Liliana’s topic of presentation was: “How Blockchain and Digital Assets / Crypto are Transforming the Finance Industry”.

16th May 2019

Bloomberg Equality Summit at Bloomberg’s HQ in London

SupraFin’s CEO, Liliana Reasor, was invited to participate in the Bloomberg Equality Summit. In the finance area, met Ana Botin, Chairman of Santander, and the most powerful woman in finance in the world. Liliana was static to learn that Ana believes that SupraFin sounds very interesting and is aligned with several of the technologies and spaces of interest to Santander.

15th April 2019

20|30 Stock Tokens Debut On London Stock Exchange

20|30, who created the The Pillar Project (a partner of SupraFin), just issued the first blockchain token shares (security tokens) on the London Stock Exchange. This is a historic moment in this new industry of digital assets / cryptocurrencies.

1st May 2019

How UK Businesses Leverage Blockchain – Blockpass Meet-up at Cocoon Networks

SupraFin’s CEO, Liliana Reasor, presented about SupraFin’s vision alongside other UK businesses that leverage Blockchain.

12th April 2019

NYC Security Token Forum in New York

Wilfred Daye, SupraFin’s Digital Asset Exchange Advisor & OKCoin’s Head of Financial Markets and Xiaochen Zhang, SupraFin’s Global Advisor & FinTech4Good’s President participated in the panel “Everything about Security Tokens Trading” at the NYC Security Token Forum. Also, Laurent Nguyen-Ngoc, SupraFin’s Chief Quant Officer was invited to the event for his expertise in quantitative models for the finance industry.

20th Feb 2019

Carnegie Mellon University’s MSCF Virtual Fireside Chat – The Future of Blockchain in Finance

Carnegie Mellon University’s MSCF program organized the first MSCF Virtual Fireside Chat: The Future of Blockchain in Finance. At the MSCF Virtual Fireside Chat, SupraFin’s CEO, Liliana Reasor was interviewed by CMU’s Associate Professor of Economics, Dr. Ariel Zetlin-Jones. You can watch the virtual fireside chat by clicking this link: Virtual Fireside Chat Video

5th March 2019

SupraFin in City AM’s Crypto Insider

SupraFin was featured at CITY A.M.’s Crypto Insider section as the company democratizing portfolio management of cryptocurrencies by empowering the individual to benefit from cutting edge analytics that lever AI and usually only available to the best quant asset managers and hedge funds.

8th Feb 2019

The FinTech Companies to Watch at London Blockchain Week 2019

“London Blockchain Week (LWB) is back for its fifth year, where a community of experts and innovators will gather to deliver a festival of events, exhibitions, thought-provoking workshops and, of course, networking opportunities.” According to the article, among the exciting FinTech players set to generate some buzz at LBW this year is SupraFin.

12th Feb 2019

London Blockchain Week

SupraFin’s CEO, Liliana Reasor, was part of the Blockchain for Social Impact panel at Blockchain Week 2019 in London. She discussed how financial inclusion could be achieved by leveraging emerging technologies like the Blockchain and AI.

18th Oct 2018

OSX Outsourcing Summit & Expo at London ExCel

Andrew Wright (SupraFin’s CTO) and Liliana Reasor (SupraFin’s CEO) participated in a panel that discussed the power of Blockchain through certain cryptocurrencies to empower global payments, decentralisation, disintermediation, democratisation and inclusion.

13th Nov 2018

The Future of Cryptocurrencies and SupraFin at IOD in London

The SupraFin team gave a presentation on the future of cryptocurrencies, SupraFin’s vision, and showcased the prototype for its mobile customer interface.

26th June 2018

Malta Business Network UK Discusses Blockchain in London

SupraFin’s CEO, Liliana Reasor, discussed Blockchain, SupraFin and utility tokens.

15th Sep 2018

Carnegie Mellon University – INTERSECT@CMU -Tech Conference in the US

SupraFin’s CEO, Liliana Reasor, participated in the panel: Decentralizing Trust: Blockchain’s Radical Potential. You can watch the panel discussion by clicking this link: Panel Discussion Video You can watch Liliana’s interview by clicking this link Liliana’s Interview Video – Poets & Quants

7th June 2018

The Blockchain International Show at ExCel London

12th June 2018

Digital Asset Investment Forum in Beijing

SupraFin’s CEO, Liliana Reasor, was invited to discuss the Blockchain innovation ecosystem and global collaboration

5th June 2018

Global Female Leaders event in Berlin

SupraFin’s CEO, Liliana Reasor, lead a think tank session titled: “How the Blockchain Technology is Transforming Business and Society”.

6th June 2018

FinTech Breakfast event in London hosted by CSFI

14th March 2018

Digital Asset Investment Forum in Seoul

SupraFin’s CEO, Liliana Reasor, participated in a Blockchain panel and also presented the concept behind SupraFin at TokenSky.

28th March 2018

Blockchain, AI and Boutique Asset Management in London

SupraFin’s CEO, Liliana Reasor, participated in a panel for New City Initiative that discussed the potential impact of Blockchain and AI on the UK boutique asset management industry.